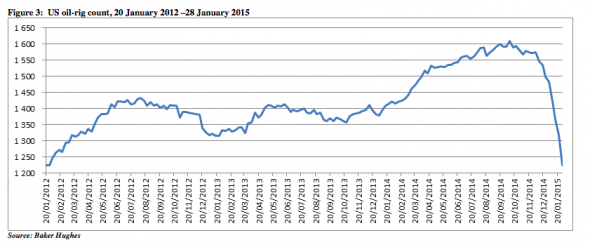

The US shale oil industry is also suffering. This graph below from industry analysts Baker Hughes shows the dramatic fall in the number of rigs operating in the US shale industry.

In just three months, the rig count has fallen by 24 per cent, or 389 from the all-time high of 1,609 recorded for the week of 10 October last year. As Mark Lewis, from Paris-based analysts Kepler Chevreux notes: “In all of the historical Baker Hughes data stretching back to July, 1987, there is no precedent for a drop of this speed or severity.”

So, what does this mean?

Lewis notes that the US rig count is a leading indicator of US supply (the more rigs there are, the more supply there will be). For this reason, it is probably the most closely watched single indicator in world oil markets at the moment, as it offers the best guide to what will happen with US shale-oil supply in the months ahead.

That matters because it is the US shale industry that has been the fundamental driver of global crude-oil supply in the last five years, and without the huge surge in shale oil since 2009 global crude-oil output would actually have been lower in 2014 than it was in 2005. This is the very supply that the Saudis and other OPEC members have been targeting.

What the sudden drop in rig count suggests, Lewis says, is that the market is starting to re-appraise the shale-oil model, derided by some as some sort of giant “Ponzi” scheme, because of its reliance on capital recycling and new drilling to replace the wells that exhaust themselves within a year or two.

The significance of this is that predictions of the shale bubble may now come true. As David Hughes, the the Post Carbon Ins ute, wrote in his analysis “Drill, Baby, Drill”, there were always questions about how sustainable the shale revolution was going to be.

“First, shale gas and shale oil wells have proven to deplete quickly, the best fields have already been tapped, and no major new field discoveries are expected,” he wrote in 2013.

“Thus with average per-well productivity declining and ever-more wells (and fields) required simply to maintain production, an “exploration treadmill” limits the long-term potential of shale resources.”

Reply With Quote

Reply With Quote