And someone who inherits cash is only comfortable when they use it

Inherently, I think it's wrong. If someone chooses to save their money for their kids, then that should be their right. And giving that money to the government doesn't insure that anything productive gets done with it anyway.

That being said, the threshold is so high that it's not going to put anyone's heirs (most anyway) at a significant disadvantage. Not to mention that plenty of the wealthy have been able to take advantage of tax benefits that most cannot.

And someone who inherits cash is only comfortable when they use it

Income sufficient to live a middle class lifestyle (decent home, car, lifestyle) without debt and ac ulate enough money to continue that lifestyle throughout retirement.

Damn, ya'll always get so triggered by a couple hundred thousand per year or a few million in the bank. It's sooo much money

It's not.

So try to stay with the original point

Do you think it is in the best interest of the country to encourage people to sell off viable small businesses and eliminate those jobs so the govt can get a little bit more money?At the same time, I would argue that the exclusion is isn't high enough. Not allowing the very rich to just hand over their wealth without any taxes is something I can agree with but we shouldn't prevent not wealthy people from passing on family farms, ranches, small businesses. It's not in the best interest of our country long term.

Nah...Ag exemptions. Wouldn't be cheap but not astronomical.

My preference would be to only tax on the sale of that land.

And you're out of touch with average Americans and the middle class. Too busy waiving your prick around. A few million bucks? Child's play!

I think it's perfectly in line with lottery winners. Except with a 5.5 million dollar exemption that can effectively double if a husband and wife split it into two trusts, each benefitting from its own 5.5 mil exemptionSo try to stay with the original point

Do you think it is in the best interest of the country to encourage people to sell off viable small businesses and eliminate those jobs so the govt can get a little bit more money?

How much do you think you will need for a good retirement?

Depends on a lot of factors.

Where do I live?

Do I own a home mortgage free?

How old am I when I retire?

How old am I when my wife retires?

Do I care about world travel by that age?

Do I have expensive hobbies at that age?

Do I have other income coming in? Property rentals, etc.

Did I work a government job long enough (public defender, for example) to the point where I get a pension?

Sitting on a $10 million ranch til you die good.

Gotta love the liberal mind.those lottery family farms and ranches.

corporate agriculture is so evil monsanto gmo's...

I don't remember complaining about gmos or Monsanto tbh. Fantastic straw man tho.

keep it on topic

I'm just ok with estate taxes given the huge exemption(s). You think people inheriting 11 million dollar ranches are lower class peasants who can't afford to pay taxes.

Family farms and ranches are all 100% certified organic?

THIS CHANGES EVERYTHING

So your ok with a 5 million exemption but not more. Why 5 million? why not less? Doesn't 5 million count as winning the lottery?

So then why bring this up

During a conversation on estate taxes

For s and giggles.

$10 m in farmland

2000 acres x $5000

half corn and soybeans

Combine and headers alone will run almost 3/4 of a million right there.

Your looking at $2-3 million in machinery

Need some bins and sheds, another half a million to a million.

I pay sales tax on all that machinery. Health insurance another $20g.

You don't have much margin of error on a large decision. The engine alone on a combine or tractor will run north of $60k.

Lets say you have to come up with $4m just to enter the game, assuming inheriting $10 m in land. What's your motivation to build an operation? Inflation alone will push you out into major tax area when your ready to retire. That $200k net? Your not continuing to farm/ranch without a lot of extra capitol. Even if you were, you need to expand at least 5% every year to remain compe ive.

IDK about farming/ranching so my numbers were just made up to make the point that a 40% estate tax can be the end of a family ranch/farm. Instead they just saw it as "That's rich!".

Hopefully you can get the federal government to pay you to not grow or raise anything.

I would tend to believe a family with a ranch/farm worth over 11 million dollars can probably afford the estate tax on that excess amount

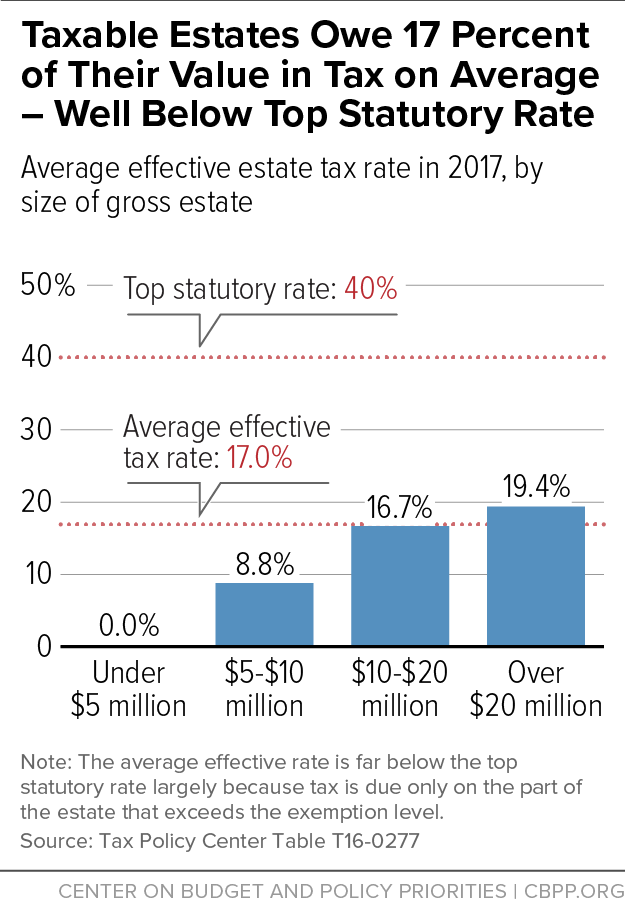

No reason to argue anymore. Apparently the govt already has put enough loopholes in place that nobody actually pays the 40%.

they can afford an estate tax advisor to minimize/avoid/evade taxes.

That's not a loophole. Read the fine print. That's exactly what my last post said. You only pay the taxes on the excess amount. If you have a 5.5 mil exemption on a 6 mil property, you're only paying tax on 0.5 mil. It's basic math. So a family with a 12 million dollar ranch is really going to pay tax on about 1 mil (assuming husband and wife each put half the ranch in individual trusts, each with their own 5.5 exemption)

No there are loopholes

https://www.cbpp.org/research/federa...ral-estate-tax

As well as...

Over the years, a number of targeted provisions have been enacted to reduce the burden of the estate tax on farms and small business owners. These include a special provision that allows farm real estate to be valued at farm-use value rather than at its fair-market value, and an installment payment provision. A provision aimed at encouraging farmers and other landowners to donate an easement or other restriction on development has also provided additional estate tax savings. Together, these provisions have reduced the potential impact of estate taxes on the transfer of a farm or other small business to the next generation.

There are currently 1 users browsing this thread. (0 members and 1 guests)