It's a Democrat plot right before the midterms, just like the bombs and the caravan.

that's probably as good as guess as any

It's a Democrat plot right before the midterms, just like the bombs and the caravan.

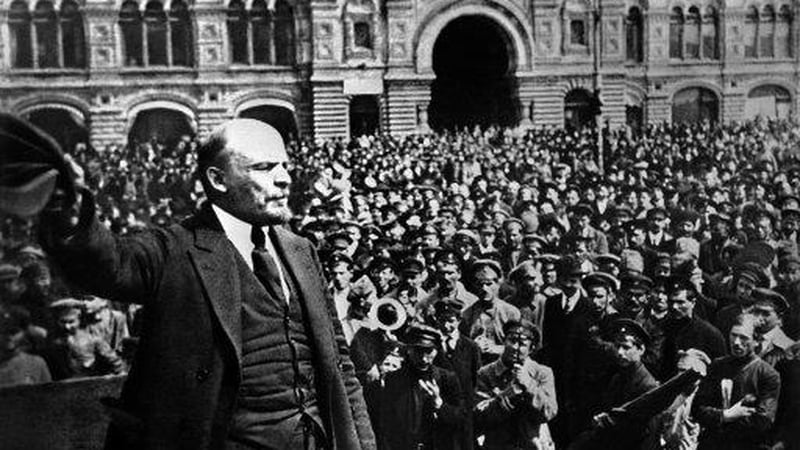

And on the 101 year anniversary of the Democrats' greatest October Surprise

Tankmode engaged

Looks like the last hours might b brutal hope ya ngs have lube

Some stocks are overvalued, interest rates are rising....but the real economy is growing over 3% annually so I suspect the market swings are over blown.

I just spoke to my portfolio manager Monday. He's a veteran--my dad has used him for probably close to 20 years...and now ME and stuff I am doing for my daughter.

I'm 45 now and he's said that if midterms go heavily republican we're going to up my risk/yield dramatically. If it goes Dem we're going to pull way back

Ducks is right on this one. GDP number today came in at 3.5%

It's your standard pre-election volatility for the robotraders to syphon off the top of inactive 401K's.

Create sell-off, drive prices down, buy back at lower cost with minimized loss.

There are signs of contagion in the global market. NASDAQ, Blue Chip, Japanese and Chinese stocks have all been down. Latin America economies are collapsing because of the rising dollar which resulted from the Fed raising its rates once again. These fed rate hikes are spilling over into the bond markets. Last March, there was a 1,000 point drop, followed by a dead cat bounce of about six months (predictable), that showed investors were getting skittish. Is this current drop a one-time thing again or is this more fundamental? There is no way the Fed can raise the rates four more times, as Powell promised, without creating a credit crunch. The Fed overreacted in 2008 and it seems to be doing the same again by raising rates too fast and for too long. Naturally, Trump is upset with Fed for this but the Fed has no choice because it has to finance the $1,000,000,000,000 a year deficit caused by Trump's tax cuts. You have to raise rates to get people to buy the U.S. Treasury bonds in order to finance this deficit.

Called dat

Called dat

200 pts in 2 hours

You must have access to some sort of top secret "pre-trade" type of stock information!

denzelmanig.gif

Fed hawks disappear, yield curve inverts on 3 month and 10 year Treasuries:

https://www.treasury.gov/resource-ce...spx?data=yield

https://www.bloomberg.com/opinion/ar...a-new-paradigm

and Moore gets nomintated by President bonkers to the fed... holy that guy is unqualified.

Letting the autism flow through me with CCIV, GME and BB.

Known Stock Market Leverage Hits WTF High. Out the Other Side of its Mouth, the Fed Warns about Hidden Leverage that Blew up Archegos

by Wolf Richter • May 18, 2021 • 181 Comments

Margin debt is just the visible tip of the iceberg of leverage, and it reached the zoo-has-gone-nuts level.

Out of the other side of its mouth, the Fed – via its blissfully ignored Financial Stability Report – is warning about leverage, stock market leverage, and particularly the vast and unknown parts of leverage among hedge funds and insurance companies.

It named names: The family office Archegos, a private hedge fund that has to disclose very little, and that then blew up because none of the brokers providing it with leverage knew about the other brokers also providing leverage, and no one knew how much total leverage the outfit had. The amount of leverage didn’t come out until it blew up.And this form of hidden leverage is not included in the known stock market margin debt reported monthly by FINRA, based on reports by its member brokerage firms.

This known stock market leverage is an indicator of the trend in leverage, the tip of the iceberg. History shows that a big surge in margin balances preceded and perhaps was a precondition for the biggest stock market declines.

In April, it exploded to a new WTF high of $847 billion, up by $188 billion in six months, having ascended to the zoo-has-gone-nuts level:

In this type of chart that covers two decades during which the purchasing power of the dollar has dropped, long-term increases in absolute dollar amounts are not the focal point; but the steep increases in margin debt before the selloffs are.

There are currently 1 users browsing this thread. (0 members and 1 guests)